- EverythingStartups Newsletter

- Posts

- EverythingStartups Weekly

EverythingStartups Weekly

Be a startup & VC insider in less than 5 minutes a week.

Welcome to all the new visionaries here who signed up last week! And hello from Europe this week.

Let’s get into this week’s edition on what’s happening in startup & VC world & the main highlights.

But first, check out these resources:

Cheers,

Ivelina

PS: Liking this? Share this newsletter with your inner circle.

Important News 🟣

X appointed Nikita Bier as head of product, tapping the viral app founder and growth hacker to drive new features like Grok-powered timelines and smarter notifications in Musk’s push to evolve the platform.

Robinhood stock hit a record high after launching tokenized shares of OpenAI and SpaceX in Europe, marking its first foray into blockchain-based private equity access and expanding crypto offerings with staking and a new L2 network.

Tech billionaires, including Palmer Luckey and Joe Lonsdale, are launching Erebor Bank to fill the void left by SVB. The hope is to serve high-risk startups and crypto firms with stablecoin-focused services under a tightly regulated national charter.

Lovable, the Swedish AI startup behind code-generating web apps, is raising over $150 million at a $2 billion valuation after hitting $50M ARR in just six months and launching an AI agent to automate full-stack development.

Ultra-unicorns valued at $5B+ are dominating private markets in 2025, with record-breaking raises like Thinking Machines’ $2B seed and OpenAI’s $40B round driving over half the Crunchbase Unicorn Board’s $6T value.

Who is Soham Parekh, the serial moonlighter Silicon Valley startups can’t stop hiring?

Interesting Links 🟣

One of the best cap table guides. Learn how to structure your ownership clearly, attract investors, and stay ahead of compliance, all without letting equity complexity slow your growth.

10 charts, one world in flux. Rex Woodbury breaks down everything from AI-powered doctors and leaner organizations to protein mania and Gen Z whiplash. A visual map of where we’re headed next.

LinkedIn isn’t broken, you’re just not using it right. Kyle Poyar shares the playbook behind 14M impressions, 14K subs, and why native graphics, counterintuitive takes, and a few weekly posts can turn it into your #1 growth channel.

Can you build a unicorn with just 10 people? Gumloop thinks you can. PitchBook profiles the AI startup chasing billion-dollar scale with a micro team, skipping sales armies and relying on AI agents, hustle, and product-led growth.

What is an AI-native employee, really? Elena Verna dives into Lovable’s hypergrowth and explains why the next 10x worker won’t ask for headcount or permission. A prompt, a tool, and the trust to ship fast are all you need.

Menlo Ventures releases new State of Consumer AI Report 2025.

🎙️ 64% of European startups now expand to the U.S. at seed stage.

Index Ventures just released Winning in the US: The Founders Guide to Building a Global Company, and it turns out Europe is no longer the warm-up act and founders aren’t waiting for Series B. Instead, they’re building transatlantic companies from day one.

Here’s why:

→ U.S. enterprise customers move faster and spend more

→ Bay Area = AI talent density + capital + distribution

→ Remote work normalized multi-office teams

→ Founders are more ambitious, earlier

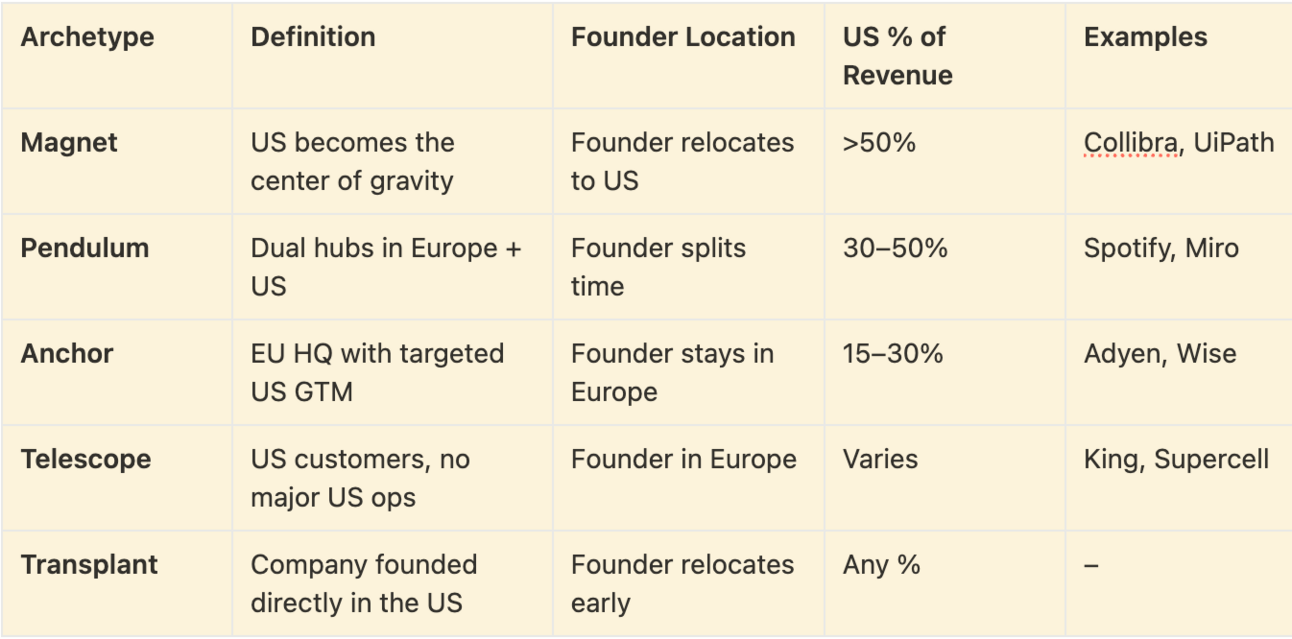

Index Ventures studied 500+ startups and identified 5 expansion archetypes:

The best HR advice comes from people who’ve been in the trenches.

That’s what this newsletter delivers.

I Hate it Here is your insider’s guide to surviving and thriving in HR, from someone who’s been there. It’s not about theory or buzzwords — it’s about practical, real-world advice for navigating everything from tricky managers to messy policies.

Every newsletter is written by Hebba Youssef — a Chief People Officer who’s seen it all and is here to share what actually works (and what doesn’t). We’re talking real talk, real strategies, and real support — all with a side of humor to keep you sane.

Because HR shouldn’t feel like a thankless job. And you shouldn’t feel alone in it.

New VC Fund Highlight: Phosphor Capital Is Betting Big on YC’s Brightest Stars 🟣

Launched in 2024 by Kulveer Taggar, a two-time YC alum, Phosphor Capital has raised $34M across two funds to back YC startups exclusively.

With YC CEO Garry Tan as an investor and a solo GP model, Taggar’s fund is betting on the accelerator’s knack for churning out unicorns. 6% of YC companies hit that billion-dollar mark, and a quarter of those become decacorns.

Based in the Bay Area, Phosphor’s already made waves, writing checks from $100K to $500K and backing over 200 YC companies, including standouts like Gumloop and Circleback, both of which have scored Series A rounds.

Brownie points for:

🍪 YC insider edge: Taggar’s deep ties to YC, from his Auctomatic days with the Collison brothers to Zeus Living’s $200M+ valuation peak, give him unmatched access to YC’s deal flow.

🍪 Founder empathy: Having navigated Zeus Living through high interest rates to a 2023 exit, Taggar’s battle scars make him a founder-friendly investor who gets the grind.

🍪 Powerhouse LPs: With Garry Tan, Zeus investors, family offices, and a large asset manager backing him, Phosphor’s got a stacked roster of believers.

🍪 AI enthusiasm: Taggar’s hyped on YC’s AI startups, riding the wave of Garry Tan’s vision to take the accelerator to new heights.

But… Can Phosphor keep the momentum?

New kid on the block: Launched in 2024, Phosphor’s still proving itself. Can it pick winners in YC’s crowded batches?

Niche gamble: Will betting solely on YC startups limit Phosphor’s upside in a hyper-competitive AI and tech landscape?

Top Pre-Seed to Series A Funding Rounds This Week 🟣

Argon AI, a New York startup that helps biopharma teams manage research projects and data using AI tools in a shared digital workspace, raised a $5.5 million seed round. Crosslink Capital, Wireframe Ventures, Y Combinator, and Pioneer Fund were part of the investors.

Deeto, a New York startup that uses AI to deliver customer quotes at key B2B buying moments, raised a $12.5 million Series A round. Jump Capital led the deal, with UpWest, TAL Ventures, Mertor, and TAU Ventures also showing up.

MediShout, a UK company that connects hospitals with medical suppliers to reduce delays and improve patient care, raised a $9 million Series A round. Heal Capital was the main investor, with Nickleby Capital and Meridian Health Ventures also contributing.

Civ Robotics, a San Francisco startup that makes autonomous surveying robots and construction deployment machines, raised a $7.5 million Series A round led by AlleyCorp. Bobcat Company and ff Venture Capital also showed up.

TopK, a Prague startup building a cloud-native search engine for querying structured and unstructured data, raised a $5.5 million seed. Earlybird, KAYA, and Irregular Expressions joined the round.

The People Behind EverythingStartups Newsletter:

Say hello here to our small team at [email protected]

EverythingStartups is a content studio for VC firms & startups. Learn more about our services and work.