- EverythingStartups Newsletter

- Posts

- EverythingStartups Weekly

EverythingStartups Weekly

Keep up with tech, new VC funds & where early-stage capital is flowing in less than 5 minutes a week.

Welcome to everyone new here who signed up last week!

I’m excited to announce the beta launch of the EverythingVC database. 👏

And here is what you get with the paid version and the launch price. Feedback is always welcome!

Let’s get into this week’s edition on what’s happening in startup & VC world + the main highlights.

But first, you might find some of these resources helpful:

New Instagram account with more great startup & VC content.

Cheers,

Ivelina

PS: Liking this? Share this newsletter with your inner circle.

Important News + Data 🟣

What people are talking about…

Sequoia names Alfred Lin and Pat Grady as new co-stewards as Roelof Botha steps down.

Andreessen Horowitz is pausing its Talent x Opportunity (TxO) fund and program.

Vulcan Elements and ReElement Technologies have signed a $1.4B rare earth magnet supply deal with the US government to scale the companies’ development of a domestic rare earth magnet supply chain.

Animoca Brands, the Hong Kong-based crypto investor and blockchain developer, plans to go public on the Nasdaq stock exchange through a reverse merger with Currenc Group Inc.

Tesla shareholders approve Elon Musk’s $1 trillion pay package, more than 75% of shareholders who participated voted to approve the plan.

Cluely’s Roy Lee hints that viral hype is not enough, admitting that brand awareness alone won’t lead to sustained growth.

Hot rounds 🔥

Hippocratic AI raised $126 million in Series C funding at a $3.5 billion valuation in a round led by Avenir Growth. CapitalG, General Catalyst, Andreessen Horowitz, and Kleiner Perkins were also part of the investors

Ripple raised $500 million in a round co-led by Fortress Investment Group, Citadel Securities, Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace.

Beacon Software raised $250 million in Series B funding at a $1 billion valuation in a round co-led by General Catalyst, Lightspeed Venture Partners, and D1 Capital.

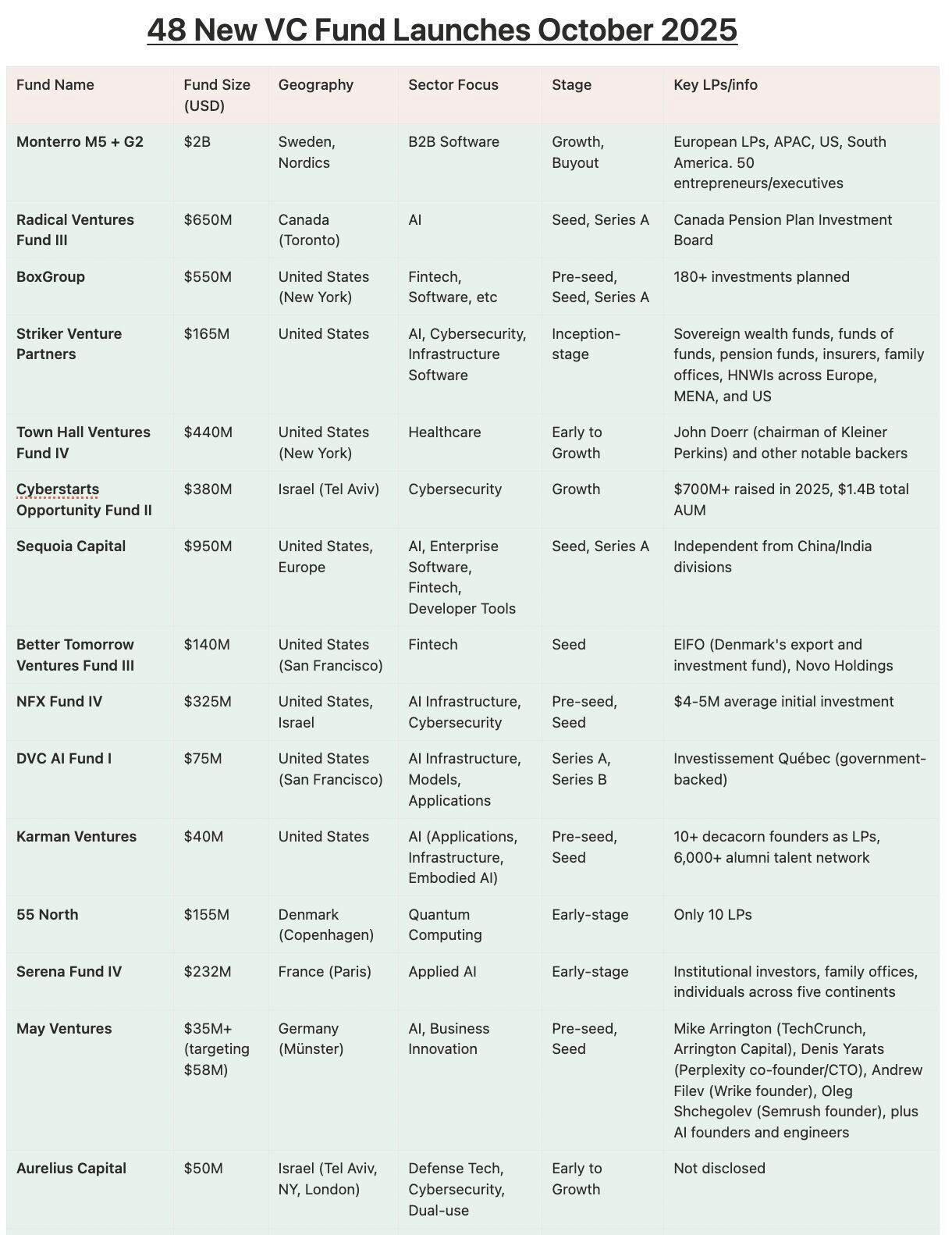

October Round up: 48 New VC Funds Announced 🟣

I am back with October’s VC trends report, let’s dive in.

Ok, October was INSANE. Literally. 🤯

$10 BILLION was raised in one month by roughly 48 new VC funds (including a few from late September).

Europe is BACK - 37% of October’s venture capital came from the continent, the highest share in years.

Quick stats:

60%% of funds are targeting pre-seed/seed.

The average fund size was $260M.

21 funds (44% of capital) explicitly targeting AI, that's $4.5B in a single month for one sector. (even the dot-com boom didn't see this level of thematic clustering?)

It was Europe’s biggest month in many years:

Monterro: €1.7B with 150 developers in Vietnam supporting portfolio companies

Notion Capital: $130M with dedicated platform teams for product/GTM/pricing

55 North: €134M for quantum computing (world's largest pure-play quantum fund)

In the image below is a snapshot of the funds announced, showing:

fund name

fund size

geography

sector focus

stage

key LPs

(The full table is in the report at the link below, hard to fit the whole one on here!)

Pulse check for October:

1. Defense tech is legitimate again

$900M+ raised for defense/dual-use in October alone.

2. Climate tech requires specialization

Generic "we care about ESG" is dead Burnt Island ($50M - water tech ONLY, Xylem as anchor LP).

3. Israeli ecosystem bifurcating

Defense tech: 500% investment surge, $168M in govt funding Everything else: Fundraising at decade-low ($260M in H1 2025)

You can get the full 20-page report over here, OR subscribe to the monthly EverythingStartups Premium newsletter where you get the monthly report + access to the newly launched VC database which is updated is every single week + any exclusive extras I might drop 😉

Interesting Links 🟣

These caught my eye this week…

The ‘new’ YC looks younger, nerdier, and more Bay Area-centric. Rebel Fund’s Jared Heyman analyzes data showing YC founders are now younger than ever (avg. 26), overwhelmingly technical, and increasingly SF-based.

37 lessons from the GP seat. Confluence VC’s latest post distills a year of hard-earned insights from building a venture firm from scratch.

How to keep winning. Replit CEO Amjad Masad shares six principles for staying in the game. From obsessing over survival and compounding progress to doing hard things and giving back, this is a playbook for founders who want to win long-term without losing integrity.

What makes a great founding team? MicroVentures breaks down how investors assess founder experience, team dynamics, and execution ability and why second-time founders have a 30% success rate versus 18% for first-timers.

Palantir’s new bet: skip college. The company is hiring 22 high-school grads for a fellowship with a four-week seminar on Western civilization, questioning whether college is still worth it.

Traffic is dead. Webflow’s VP of Growth says AI search now converts 6x better than Google, driving 10% of new signups from ChatGPT referrals. Kyle Poyar breaks down how the company is rewriting its playbook for the LLM era.

🎤 The 12 Signals LPs Use to Spot Top Emerging Managers

Every LP faces the same riddle: how do you spot a future outperformer when there’s no track record to prove it? The next Sequoia or Andreessen is, by definition, invisible at inception.

Yet some LPs - like Beezer Clarkson at Sapphire Partners, Michael Kim at Cendana, and Samir Kaji at Allocate - have built their reputations by doing exactly that: picking emerging managers before the data exists.

What most first-time GPs misunderstand is how structured this process has become, LPs aren’t swayed by charisma or access alone. They follow a quiet, 12-point diligence framework that probes everything from team cohesion and portfolio math to alignment and governance hygiene.

There’s $17 trillion sitting in retirement accounts, yet most founders and VCs don’t realize it can be tapped for their private raises.

Alto makes it easy for founders to accept IRA investments and for VC operators to unlock a new source of committed capital.

If you’re raising or helping others raise, this could be the most overlooked way to expand your capital base.

New Fund Highlight: MVP Ventures 🟣

MVP Ventures closed Fund II at $125M for early-stage AI, hardware, and software.

This fund is actually interesting because...

While most firms talk about "founder support," MVP reports 1.45x TVPI (top 5% for vintage) and has 50+ portfolio companies publicly calling them their most valuable investor, a 5-10x higher endorsement rate than peers. They earned super pro-rata rights in 30 follow-on rounds led by Sequoia, a16z, and Founders Fund.

The team combines ex-a16z, Robinhood, DocuSign, and Department of Defense operators with proprietary sourcing tech and 16-person post-investment infrastructure. Based in San Francisco, they meet founders early, often before first funding, backing companies like Anduril, Saronic, Gecko Robotics, and Dataminr..

Why it's notable:

Performance proves the model. Top 5% TVPI.

Infrastructure advantage. "10x more post-investment infrastructure than peers".

Compounding access arbitrage. When 30 companies expand your allocation and founders choose you again for their next startup, you've built a flywheel most firms only pretend to have.

Top Pre-Seed to Series A Funding Rounds This Week 🟣

Watch out for these…

Wabi, a San Francisco startup founded this year that lets users create and share mini apps using prompts, raised a $20 million pre-seed round. Investors included Naval Ravikant, Garry Tan, Justin Kan, Amjad Masad, Akshay Kothari, DJ Seo, and Sarah Guo.

Fintary, a San Francisco startup that streamlines commission and financial operations for insurance companies, raised a $10 million Series A round led by Infinity Ventures, with previous investor Sierra Ventures also investing. The company has raised a total of $12.8 million.

Fit Collective, a London startup that uses AI to help fashion brands improve sizing and reduce returns, raised a $3.9 million pre-seed round led by AlbionVC and including SuperSeed, True Global, January Ventures, and Innovate UK.

Malanta, an Israeli startup that provides pre-attack prevention software to neutralize threats before they materialize, raised a $10 million seed round. Cardumen Capital was the lead investor, with The Group Ventures also joining in.

GitLaw, a San Francisco startup that helps businesses draft, review, and manage legal contracts with AI, raised a $3 million pre-seed round led by Jackson Square Ventures.

Signing off, have a good weekend folks!

The People Behind EverythingStartups Newsletter:

Say hello here or here: [email protected]

EverythingStartups is a content studio for VC firms & startups. Learn more about our services and work.