- EverythingStartups Newsletter

- Posts

- EverythingStartups Weekly

EverythingStartups Weekly

Keep up with tech, new VC funds & where early-stage capital is flowing in less than 5 minutes a week.

Welcome to everyone new here who signed up last week!

Let’s get into this week’s edition on what’s happening in startup & VC world + the main highlights.

But first, you might find some of these resources helpful:

For partnership queries: [email protected]

New Instagram account with more great startup & VC content.

Cheers,

Ivelina

PS: Liking this? Share this newsletter with your inner circle.

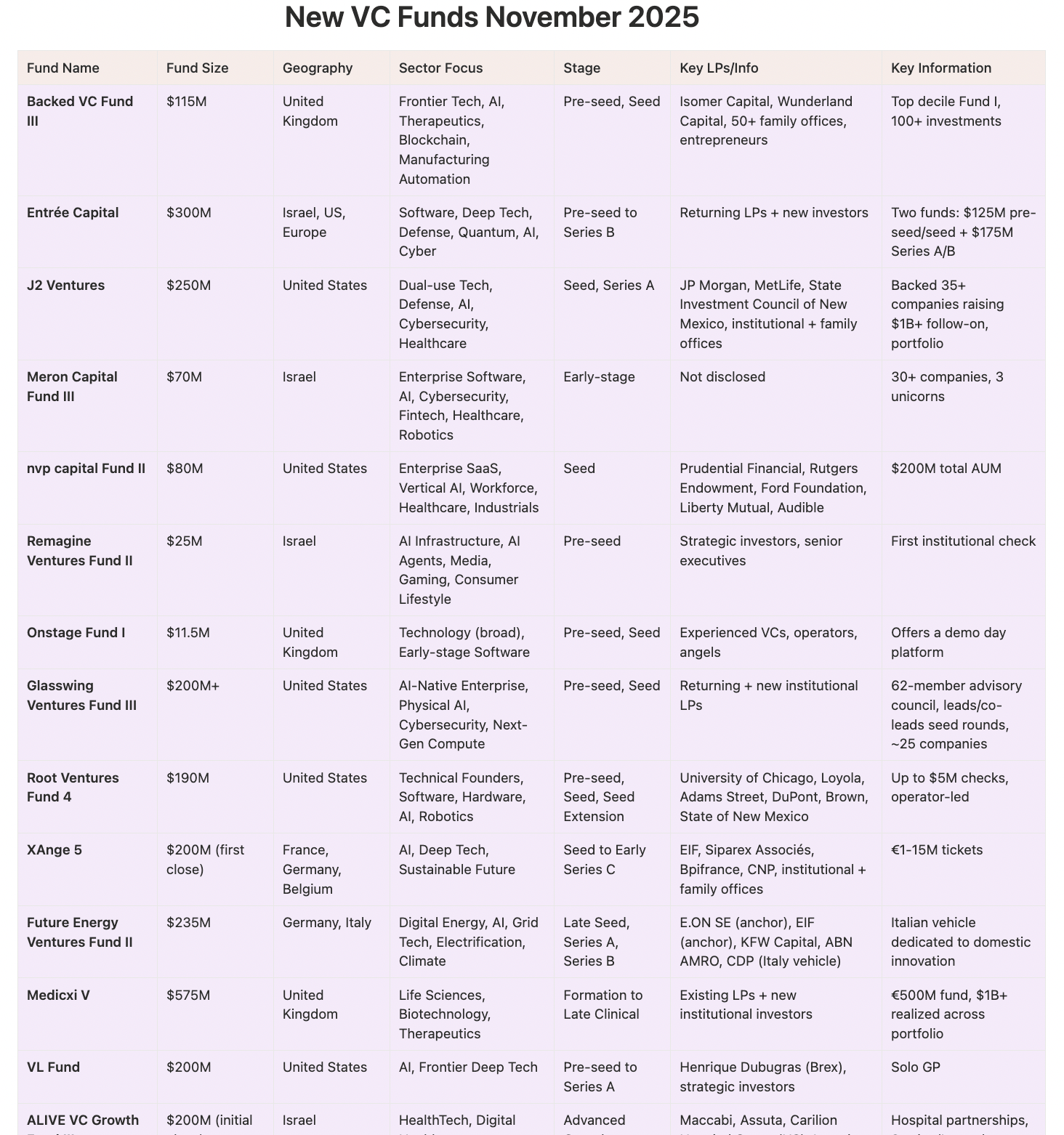

New VC Funds 🟣

Fresh capital in the past week…

Female Founders Fund – $29M for Consumer, Health, Fintech, Enterprise (Women-led Startups)

Indico Capital Partners – €125M for AI, SaaS, Deep Tech, Oceantech

Propeller – $50M for AI Infrastructure, Developer Tools (MENA focus)

6 Degrees Capital – €154M for AI, Fintech, Enterprise Software

Anti Fund – $30M for AI, Robotics, Frontier Tech

Valkyrie – $45M for AI, Deep Tech, Critical Systems

Vibe Check 🟣

Signals 📈

Across USA, Europe, Israel

SpaceX is laying the groundwork for a possible IPO in 2026.

Stanford’s star reporter takes on Silicon Valley’s ‘money-soaked’ startup culture. His upcoming book promises an explosive look at how venture capitalists treat Stanford students as “a commodity,” wooing favored undergrads with slush funds, shell companies, yacht parties, and funding offers before they even have business ideas in their hunt for the next trillion-dollar founder.

Tiger Global has launched a new venture fund targeting $2.2 billion, signaling a sharper pullback from its aggressive investing pace of the early 2020s. The firm says it is returning to smaller, more disciplined fund sizes while concentrating capital on a tighter group of winners, amid concerns that AI valuations are running ahead of fundamentals.

Venture firms are facing their toughest fundraising environment in more than a decade, even as AI drives a surge in startup activity. The number of new VC funds raised has fallen to a ten-year low, reflecting LP fatigue after the pandemic boom and growing pressure on managers raising follow-on funds.

OpenAI fires back at Google with GPT-5.2 after ‘code red’ memo.

PR advisor Lulu Cheng Meservey has raised $40 million for a new venture fund, marking a move from communications into investing. The fund reflects a growing belief that narrative control and direct-to-market messaging are becoming core advantages for startups.

A European-focused VC firm is launching a new multi-stage fund to tackle the region’s scaleup capital gap, bringing on Nick Clegg as a general partner and Meta’s outgoing chief AI scientist Yann LeCun as an advisor.

European tech funding cooled in November 2025, dropping to €4.6 billion, but the month still produced several outsized rounds led by fintech, mobility, energy, and deeptech companies.

Israeli cybersecurity startups raised $4.4 billion across 130 funding rounds in 2025, with global investors overtaking local funds as the leading source of capital at every stage.

An Israeli-founded drone startup crossed a $1 billion valuation after raising $100 million, becoming the country’s first defense tech unicorn.

Brain Fuel ⚡

a16z just released a two-part series on what GPs think are the best and biggest bets and tech ideas to build in 2026.

Storytelling is alpha in VC, and it is a core part of Day One Ventures’ investing model. Founder Masha Bucher’s breaks down why she sees it as essential to building conviction, credibility with reporters, and long-term value from day one.

Now is a great time to sell your company, here’s why, explained by top VC, Bilal Zuberi of Red Glass Ventures.

The AI boom may create real winners, but many workers will spend years grinding under extreme expectations only to see companies fail and equity evaporate, leaving behind lost time rather than lasting rewards.

In frothy markets, here’s what defines the strongest venture managers.

The strongest predictor of startup success, according to Jason Freedman, GP at Orange Collective and former YC partner, who had analyzed over 8,000 YC applications.

Hot rounds 🔥

Unconventional AI, a four-month-old startup building an energy-efficient computer for AI, raised $475 million in seed funding at a $4.5 billion valuation. The round was led by Andreessen Horowitz and Lightspeed, with participation from Lux Capital and DCVC.

Fal raised $140 million in a Series D round at a $4.5 billion valuation, as investors doubled down on its platform for hosting image, video, and audio AI models for developers. The round was led by Sequoia Capital, with participation from Kleiner Perkins, Alkeon Capital, Andreessen Horowitz, and Bessemer Venture Partners.

Airwallex, a global fintech providing cross-border banking and multicurrency payment services for businesses, raised $330 million at an $8 billion valuation. The round included T Rowe Price and Robinhood Ventures.

Port, a Tel Aviv startup, raised a $100M Series C at an $800M post-money valuation led by General Atlantic, with participation from Accel, Bessemer Venture Partners, and Team8. The startup offers an internal developer portal and agent orchestration layer for engineering teams.

Deep dive: Monthly VC Report 🟣

AI officially dominates the majority of new venture capital funds.

In November, 63% of new funds launched had AI at the core of their thesis, up from 44% in October.

Quick stats for November:

$6.5 billion deployed across 38 new funds

median fund size was $125M

median initial checks around $1M

Read more here about the 6 trends shaping VC + get the full report by upgrading to Premium.

|

New Fund Highlight: Holly Ventures Solo-GP Fund 🟣

This fund is actually interesting because…

John Brennan spent years watching cybersecurity founders at YL Ventures get buried in term sheets but struggle to find investors who actually understood their product. So he left to launch a $33M solo-GP fund that does one thing: seed-stage cybersecurity, nothing else.

Holly Ventures typically writes checks into $5-10M rounds alongside larger leads. Based in San Francisco, six investments already deployed, two already at Series A.

Why it's notable:

Network arbitrage. LPs include GPs from Bessemer, Ballistic, CRV, Wing, IVP, TCV, Notable, Team8, plus institutions like Vanderbilt and Okta Ventures. This gives founders the Rolodex of a $500M fund without surrendering board seats or cap table ownership to someone who'll hand them off to an associate.

Filling the gap platforms created. Seed cybersecurity is getting squeezed: mega-funds moved upstream, angels lack sector depth, and traditional seed funds can't compete on technical credibility. Holly Ventures co-invests rather than competes, already syndicated with Index, Sequoia, General Catalyst, and Foundation Capital. Founders get specialist support without blocking future rounds.

U.S.-Israel cyber corridor as unfair advantage. Brennan's dual-market experience matters more than it sounds - Israel produces technical talent, U.S. provides customer access, and most funds only understand one side. Cybersecurity is one of the few sectors where cross-border seed expertise actually translates to tangible value (customer intros, executive hiring, board prep) instead of just being marketing copy.

Wall Street Isn’t Warning You, But This Chart Might

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Top Pre-Seed to Series A Fundings of the Week 🟣

[6-12 Dec 2025 covering USA, Europe, Israel]

Tier One VC Moves (these startups were backed by top VCs):

Aaru (New York) raised $50M+ Series A led by Redpoint Ventures, with participation from A*, Abstract Ventures, General Catalyst, Accenture Ventures, and Z Fellows. The startup uses AI to simulate user behavior and deliver near-instant customer research.

Multifactor (San Francisco) raised $15M seed led by Nexus Venture Partners, joined by Y Combinator, Taurus Ventures, Honeystone Ventures, Flex Capital, Pioneer Fund, Ritual Capital, Liquid2 Ventures, and Gokul Rajaram. The company is building post-quantum secure, shareable access infrastructure for humans and AI agents.

Guide Labs (San Francisco) raised $9M seed led by Initialized Capital, with Tectonic Ventures, Y Combinator, Lombardstreet Ventures, E14 Fund, and Pioneer Fund participating. It develops interpretable AI systems that can be debugged and audited by humans.

Ply (New York) raised $8.5M led by Ferguson Ventures, with Primary and SignalFire also investing. The company provides inventory and purchasing software for trade contractors.

Radical Health (San Francisco) raised $5M pre-seed led by Khosla Ventures. The startup uses AI to personalize cancer care.

Radial (New York) raised $50M Series A led by General Catalyst, with Solari Capital, JSL Health Capital, Founder Collective, BoxGroup, and Scrub Capital participating. The company builds clinical infrastructure and reimbursement tools for advanced mental health treatments.

Unconventional AI (San Diego) raised $475M seed led by Andreessen Horowitz and Lightspeed Ventures, with Lux Capital and DCVC joining. The four-month-old startup is building a new energy-efficient computer architecture for AI workloads.

Prime Security (New York) raised $20M Series A led by Scale Venture Partners, with Foundation Capital and Flybridge Ventures also investing. The company develops autonomous AI agents for design-stage software security reviews.

Pryzm (Boston) raised $12.2M seed led by Andreessen Horowitz, with participation from XYZ, Amplify.LA, and Forum Ventures. The startup uses AI to streamline defense-tech procurement for U.S. government agencies and contractors.

Resemble AI (Mountain View) raised $13M, backed by Berkeley CalFund, Berkeley Frontier Fund, Comcast Ventures, Craft Ventures, Gentree, Google’s AI Futures Fund, IAG Capital Partners, Javelin, KDDI Open Innovation Fund, Okta Ventures, Sony Innovation Fund, Taiwania, and Ubiquity. The company builds tools to detect AI-generated deepfakes across audio, video, images, and text.

Quanta (San Francisco) raised $15M Series A led by Accel, with participation from Operator Collective, Naval Ravikant, Designer Fund, and Basecase. The company provides an accounting platform built specifically for startup finances.

Scowtt (Seattle) raised $12M Series A led by Inspired Capital, joined by LiveRamp Ventures, Angeles Investors, and Angeles Ventures. The startup uses first-party CRM data to improve paid advertising performance.

AnySignal (El Segundo, CA) raised $24M Series A led by Upfront Ventures, with BlueYard Capital and First In Ventures also investing. The company builds radios for space and defense communications.

Aradigm (Bethesda, MD) raised $20M Series A led by Frist Cressey Ventures, with participation from Andreessen Horowitz and Morgan Health. The startup helps employers and insurers manage access to ultra-expensive cell and gene therapies by pooling risk and coordinating care.

Interchange (Portland, OR) raised $17M seed, backed by MS&AD Ventures, BoxGroup, Plug and Play Ventures, and Liquid2. The company builds correspondent clearing infrastructure and developer tools for securities products.

a2z Radiology AI (Boston) raised $4.5M seed co-led by Khosla Ventures and SeaX Ventures. The startup develops AI systems that triage urgent conditions on abdomen-pelvis CT scans.

Runware (San Francisco) raised a $50M Series A led by Dawn Capital, with participation from Comcast Ventures, Speedinvest, Insight Partners, and Andreessen Horowitz. The company provides a developer platform for real-time generation of images, video, and audio.

Bobyard (San Francisco) raised a $35M Series A led by 8VC, with participation from Pear VC, Primary Venture Partners, Tishman Speyer, RXR, Caffeinated Capital, and Merrick Ventures. The startup builds AI tools that help contractors automate construction takeoffs and cost estimates.

Medra (San Francisco) raised a $52M Series A led by Human Capital, with participation from Lux Capital, Neo, NFDG, Catalio Capital Management, Menlo Ventures, 776, and Fusion Fund. The company is developing autonomous robotics systems to run and manage lab experiments.

Valinor (San Francisco) raised a $13M seed round backed by CRV, Harpoon Ventures, Amino Collective, and Pelion Venture Partners. The startup uses machine learning to help drug developers identify patients most likely to respond to new therapies.

Kilo Code (San Francisco) raised an $8M seed round led by Cota Capital, with participation from Breakers, General Catalyst, Quiet Capital, and Tokyo Black. The company is building an open-source AI coding agent to accelerate software development.

On Me (San Francisco) raised a $6M seed round led by NFX, with participation from Lerer Hippeau and Focal. The startup offers a mobile-first platform for purchasing digital gift cards organized by interest.

Worktrace AI (San Francisco) raised a $9.3M seed round backed by Conviction, 8VC, OpenAI, Zero Shot, SV Angel, Genius Ventures, and Mira Murati. The company is building AI agents to automate internal business workflows.

Other Notable Early-Stage Rounds:

Empromptu (San Francisco) raised $2M pre-seed led by Precursor Ventures, with participation from Alumni Ventures, Founders Edge, Rogue Women VC, South Loop, and Zeal Capital. The startup builds software that helps companies develop self-improving AI applications.

Opine (Durham, NC) raised $5M seed led by S3 Ventures, joined by Knoll Ventures, Atlanta Seed Company, Gray Ventures, Propel Ventures, and Triangle Tweener Fund. The company builds an AI workspace designed for complex B2B sales teams.

BoodleBox (Tysons, VA) raised $5M seed co-led by Dogwood Ventures and Osage Venture Partners, with JFFVentures, ECMC Group, Hivers and Strivers, Service Provider Capital, the UVU Wolverine Fund, and City Light Capital participating. It develops collaborative AI software for higher education.

Anaphite (Bristol, UK) raised $1.8M in a round co-led by Elbow Beach and World Fund. The company develops dry electrode coating technology for electric vehicle batteries.

Spark Cleantech (France) raised $19.8M Series A co-led by 360 Capital and Taranis, with participation from the Île-de-France Reindustrialisation Fund and existing investor Asterion Ventures. The startup uses pulsed plasma technology to decarbonize high-temperature industrial processes.

Shapes (Israel) raised $15M Series A led by Entrée Capital, with NFX and F2 also participating. The company builds software to manage core human resources workflows and employee data.

Safebooks (Israel) raised $15M seed co-led by 10D, Propel Ventures, and Mensch Capital, with participation from Moneta Venture Capital, Magnolia Capital, Cerca Fund, and Blue Moon. The startup automates verification and reconciliation of revenue data across finance systems.

Laigo Bio (Netherlands) raised $13.4M seed co-led by Kurma Partners and Curie Capital, joined by Argobio Studio, Angelini Ventures, Eurazeo, the Oncode Bridge Fund, ROM Utrecht Region, and Cancer Research Horizons. The company develops therapies that degrade disease-driving membrane proteins for autoimmune and oncology indications.

Govstream.ai (Seattle) raised $3.6M seed led by 47th Street Partners, with Nellore Capital and Ascend also investing. The startup builds AI-native permitting tools for local governments.

Helmet Security (Washington, DC) raised $9M in a round co-led by SYN Ventures and WhiteRabbit Ventures. The company secures connections between AI agents and software and data systems.

Hypercritical (London) raised $2.7M pre-seed led by Join Capital, with Octopus Ventures, Tiny Supercomputer Investment Company, and Plug and Play participating. The startup uses formal logic to generate verifiable control software for safety- and mission-critical systems.

Equixly (Florence, Italy) raised $11.6M Series A led by 33N Ventures, with Alpha Intelligence Capital, JME Ventures, 360 Capital, and Fondazione Cassa di Risparmio di Firenze participating. The company develops AI-powered software for API penetration testing.

Lin Health (Denver) raised $11M Series A led by Proofpoint Capital, with participation from Osage Venture Partners, NewHealth Ventures, aMoon, Mayo Clinic, Saban Ventures, Shoni HealthVentures, and Viola Ventures. The startup delivers virtual behavioral care for chronic pain patients.

Algori (Madrid) raised $4.2M in a round led by Red Bull Ventures, joined by Tech Transfer Agrifood (Clave Capital), Co-Invest Capital, AttaPoll, Firstpick, Shilling, Flashpoint, and Change Ventures. The company helps brands and retailers improve distribution, sales, and marketing.

Rotostitch (San Francisco) raised $1M pre-seed co-led by Boost VC and Nova Threshold. The startup develops automated textile manufacturing systems for apparel production.

Corma (Paris) raised $3.8M seed led by XTX Ventures, with Tuesday Capital, Kima Ventures, 50 Partners, and Olympe Capital participating. The company helps IT teams monitor SaaS licenses, access, and usage across their software stack.

Melt&Marble (Gothenburg, Sweden) raised $8.1M Series A led by Industrifonden, with participation from the EIC Fund, Beiersdorf, Valio, Chalmers Ventures, and Catalyze Capital. The company uses precision fermentation to produce designer fats for food and personal care applications.

Nu Quantum (Cambridge, England) raised $60M Series A led by National Grid Partners, with Gresham House Ventures, Morpheus Ventures, and existing investors including Amadeus Capital Partners, IQ Capital, and Presidio Ventures also participating. The startup builds networking infrastructure to link and scale quantum computers.

Vatn Systems (Portsmouth, RI) raised $60M Series A led by BVVC, with Hanwha, Geodesic Capital, Airbus Ventures, Dauntless Ventures, Trousdale Ventures, Veteran Ventures Capital, and several existing investors participating. The company builds autonomous underwater vehicles for military and commercial use.

EpilepsyGTx (Cambridge, UK) raised $32.7M Series A backed by XGEN Venture, the British Business Bank, and a global biopharmaceutical partner. The startup develops gene therapies to treat refractory epilepsy.